Debt strategy

Several factors associated with supporting Victorians to manage the impacts of the pandemic (including payment deferrals, extensions and suspension of debt activities) have impacted debt recovery, and led to higher than typical levels of debt over the previous two financial years.

To assist customers with payment of their debts and offset the impact of the pandemic, we offered an amnesty until 30 June 2022 that waived all late payment interest accrued on outstanding debts.

This amnesty was successful in reducing higher debt levels that had accrued over the pandemic period.

From 1 July 2022, we conducted a targeted and phased return to more normal debt recovery activities, managing the recovery of debt from the relatively small portion of our customers who had not complied with their payment obligations. This included maintaining a focus on resolving smaller value, larger volume debts to minimise the number of aged debt cases.

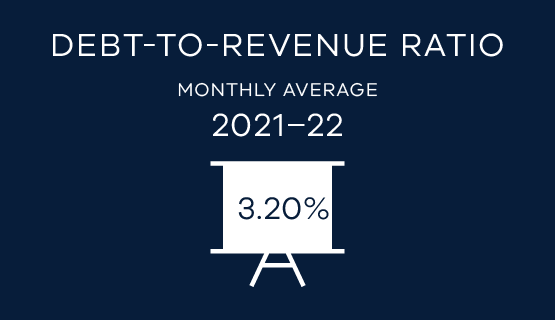

For 2021-2022, the debt to revenue ratio monthly average was 3.20%.

| Tax base | Total debt 30 June 2021 ($) |

< 30 days ($) |

30-90 days ($) |

> 90 days ($) |

Provision for doubtful debt ($) | Total debt 30 June 2022 ($) |

|---|---|---|---|---|---|---|

| Duties debt | ||||||

| Land transfer/mortgage | 30,504,493 | 673,2511 | 3,760,173 | 1,9720,047 | 8,952,316 | 30,212,731 |

| Insurance | 3,418,606 | 0 | 44 | 118,992 | 10,966 | 119,036 |

| Hire of goods | 193 | 0 | 0 | 0 | 0 | 0 |

| Motor vehicle duty | 1,825,207 | 9,509 | 390,279 | 1,792,072 | 8,860 | 2,191,860 |

| Total duties | 35,748,499 | 6,742,020 | 4,150,496 | 21,631,111 | 8,972,142 | 32,523,627 |

| Other taxes | ||||||

| Payroll tax | 104,324,562 | 9,431,219 | 14,020,263 | 88,880,397 | 70,696,059 | 112,331,879 |

| Land tax | 752,249,735 | 429,911,858 | 22,062,799 | 258,215,214 | 0 | 710,189,871 |

| Vacant residential land tax | 2,221,003 | 193,900 | 3,828,804 | 6,567,242 | 0 | 10,589,946 |

| Congestion levy | 26,840,295 | 1,070 | 44,464 | 14,701,779 | 1,064,060 | 14,747,313 |

| Commercial passenger vehicle service levy | 2,109,480 | 473,181 | 476,655 | 3,077,729 | 210,389 | 4,027,565 |

| Wagering and betting tax | 0 | 25,574 | 0 | 0 | 0 | 25,574 |

| Cattle and swine duty | 438,011 | 6,863 | 11,130 | 191,684 | 0 | 209,677 |

| Total other taxes | 888,183,086 | 440,043,665 | 40,444,115 | 371,634,045 | 71,970,508 | 852,121,825 |

| All taxes | 923,931,585 | 446,785,685 | 44,594,611 | 393,265,156 | 80,942,650 | 884,645,452 |

| Summary of written off debt 2021-22 | $ |

|---|---|

| Hire of goods | 193 |

| Congestion levy | 86,428 |

| Motor vehicle duty | 47,478 |

| Land transfer/mortgage | 2,647,052 |

| Payroll tax | 16,870,946 |

| Land tax | 931,205 |

| Commercial passenger vehicle service levy | 1,366 |

| Insurance | 51 |

| Sheep and goat | 0 |

| Cattle and swine | 5,896 |

| Sundry debts | 0 |

| Total debt written off | 20,590,615 |