Our website

Our website is the primary source of information for the services we administer and the gateway to digital applications including Duties Online, My Land Tax, Payroll Tax Express, calculators and SmartForms.

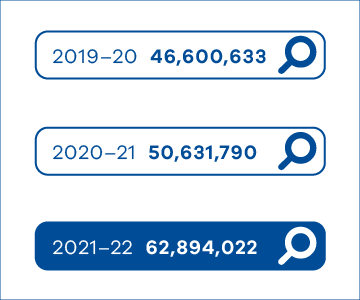

Engagement with our website and online applications continues to increase each year:

- Page views — 62.9 million, up 24.3% from 50.6 million in 2020–21

- Visitor sessions — 11 million, up 10.6% from 9.9 million in 2020–21.

Our website hosts a range of self-assessment tools including calculators to assist customers with estimating concessions, duties and taxes, and decision tools that determine eligibility for grants, duties and registrations.

In 2021–22:

- Applications accounted for 62% of all online page views, 64.4% of which were related to Duties Online.

- Calculators received more than 4 million visits — our stamp duty calculator was the most visited.

- There were more than 336,000 visits to our decision tools, the most popular topics being Will I be eligible for the First Home Owner Grant? and Am I eligible for the Homebuyer Fund?

- My Land Tax received more than 3.2 million page views.

- There were more than 22,000 views of SRO videos, the most popular being the Homebuyer Fund participants video with 9,8223 views.

Measuring and improving our online services

Our business decisions are supported by real-time reporting data and analytical tools. Web analytics data is collected across our online systems and customer feedback is collected through our website via pop-up website surveys and on-page feedback questions. We use this data to improve the content and functionality of our digital products and online services.

We also work closely with customers and industry stakeholders to co-design and test our systems to ensure these are easy to use and meet expectations.

Website visitor sessions

Other online channels

We engage with customers through a number of other online channels including:

- Email newsletters to 194,000 subscribers.

- LinkedIn updates to 2500 followers.

- Targeted email campaigns sent to our customers and other stakeholders.

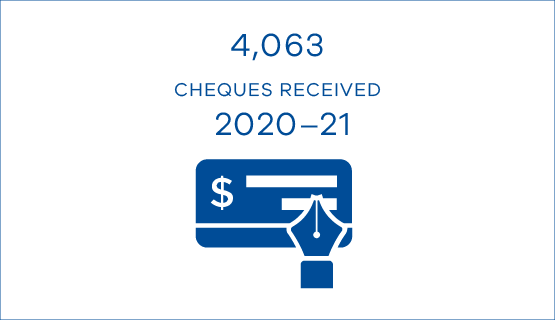

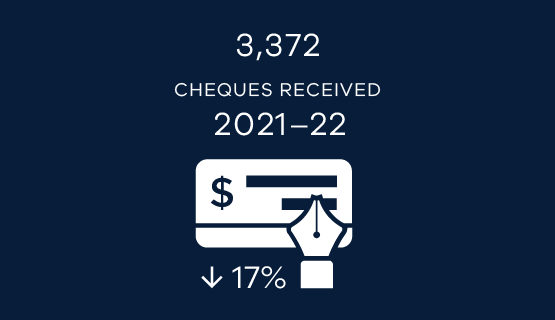

Increased uptake of online payment

In line with customer preferences and broader trends, we continue to increase access to online payment options. In 2021-22 we received 17% fewer cheques (3372), representing a continued downward trend over recent years.