In October 2021, the Victorian Homebuyer Fund (VHF) was launched as a shared equity home ownership scheme where the State makes a financial contribution in exchange for a share, or proportional interest, in a property.

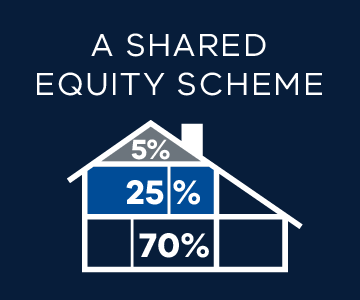

The $500m scheme allows people to work with a lender to buy a house sooner without the burden of saving for a large deposit. Eligible homebuyers receive a contribution of up to 25% towards the purchase price of their property from the State of Victoria, reducing their minimum required deposit to 5% and avoiding the need to pay Lenders Mortgage Insurance. The buyer then works with their choice of a small group of approved lenders to seek the remaining 70% of the purchase price.

For eligible Aboriginal or Torres Strait Islander homebuyers, this contribution is up to 35% and the minimum required deposit is 3.5%.

Ultimately, the VHF will support more than 3,000 Victorians to become homeowners.

From launch until 30 June 2022, the Victorian Government has directly invested more than $260m to help more than 1,600 Victorians buy a home through the VHF. As at July 1, another 1,200 had been approved to participate in the scheme and were house hunting.

Between October 2021 and 30 June 2022:

- About 90% of the settled properties were in metro Melbourne. More than 170 of the VHF customers are were based in regional Victoria.

- The top 5 metro Melbourne purchase locations were Pakenham, Tarneit, Point Cook, Reservoir and Truganina.

- The top 5 regional Victoria purchase locations were Geelong, Ballarat, Bendigo, Gippsland and Bass Coast.

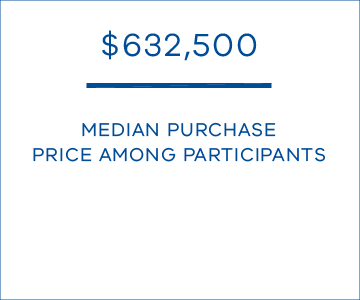

- The median purchase price among participants was $632,500.

- The largest age group of participants were millennials, aged 25-34.

- 49% of purchases have been by single participants, while 51% have been by multi-person households, mostly couples.